VA loan Myths for SW Florida

We’ve all heard the rumors: "VA loans take forever," "The appraisal is a nightmare," and "The buyer has no skin in the game." In a market like ours, from the growth in Lehigh Acres to the luxury of Naples; these myths are costing agents good deals. I want to clear the air so you can help your sellers say "yes" to our veterans without the stress.

Here are 3

things people get wrong about VA:

1. The

"Tidewater Initiative" is your secret weapon Most agents fear a

low VA appraisal is the end of the road. It’s actually the opposite. VA is the only loan type with a built-in

"Tidewater" process. If the appraiser can’t find the value, they must notify us before finalizing the report.

This gives us a 48-hour window to provide our own comps. It’s a second chance

most conventional loans don’t offer.

2. There are

NO loan limits (No, really) As of 2026, for veterans with full entitlement,

the VA has no maximum loan limit.

If a veteran qualifies for a $2.5M home in Punta Gorda or Fort Myers, they can

still do it with $0 down. The

"limit" is simply what their income can support.

3. The

"Weak Buyer" Myth Just because a buyer puts 0% down doesn't mean

they're broke. Many VA buyers are actually better capitalized than FHA or even

some Conventional buyers; they are simply choosing to keep their cash in the

bank (or the market) because they earned the right to. In fact, VA loans historically

have lower default rates than conventional ones.

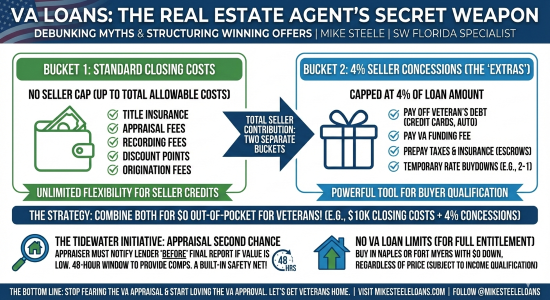

BONUS info!! Unlimited Closing Cost Credits The VA does not have a cap on

how much a seller can pay toward a buyer's "allowable" closing costs.

This includes things like title insurance, appraisal fees, recording fees, and

even discount points. If the closing costs are $12,000 on a $300,000 home

(which is 4%), the seller can pay every penny of it without even touching the

"Concession" bucket.

2. The 4%

"Concession" Bucket (The Extras) The 4% cap only kicks in for

"concessions, things that aren't strictly closing costs. This is where VA

loans get powerful. That 4% cap applies only to specific concession

items (like prepaid items, funding fee, or paying off collections) not

total closing costs

A seller can use this 4% to:

· Pay off a veteran's debt (credit cards or car loans)

to help them qualify

· Pay the VA Funding Fee on the buyer’s behalf

· Taxes and insurance (escrows)

The

Strategy: A seller could technically pay $10,000 in standard closing costs PLUS an additional 4% in

concessions. This allows a veteran to walk into a home in Cape Coral or Fort

Myers with literally zero

dollars out of pocket and maybe even a paid-off credit card.

The Bottom Line: Don’t let a myth kill your

commission. A VA offer isn’t a "headache" it’s a high-probability

closing for a buyer who has earned the easiest terms in the market.

Mike Steele Loan Officer | SW Florida Specialist MikeSteeleLoans.com Follow for more tips: @mikesteeleloans

.png)

Comments

Post a Comment